Time for a confession.

I routinely

mock bureaucrats, but I don’t really think they are any worse than other people. Indeed, I have plenty of friends and acquaintances who work for various levels of government and they are fundamentally decent people.

The real problem is that bureaucracies create bad incentives. So even people who are generally good will be tempted to

exploit rules that

reward bad behavior.

And some of these folks, operating in systems with bad incentives, will morph into bad people. Heck, some of them are so awful that I elect them to the

Bureaucrat Hall of Fame.

But it’s also important to recognize other bureaucrats – as well as the perverse rules that encourage their bad actions.

Let’s start with a cop in New Jersey who

went above and beyond the call of duty, at least if the call of duty involves ripping off taxpayers.

…former Police Chief Philip Zacche…could spend the first decade of his retirement in federal prison after he admitted to stealing $31,713 from an agency that serves the city’s neediest families. Federal prosecutors said Friday that Zacche filled out phony time sheets to get paid for security work that he never performed for the Jersey City Housing Authority. …As a member of the department’s brass, Zacche pulled a six-figure salary before overtime. He earned even more by working an off-duty part-time gig as a security officer for the Authority’s Marion Gardens housing development. When he retired in June, city taxpayers had to cut Zacche a check for $512,620 to compensate him for 450 unused comp and vacation days. The 61-year-old Manalapan resident is now set to collect a pension of at least $11,946 every month for the rest of his life.

…former Police Chief Philip Zacche…could spend the first decade of his retirement in federal prison after he admitted to stealing $31,713 from an agency that serves the city’s neediest families. Federal prosecutors said Friday that Zacche filled out phony time sheets to get paid for security work that he never performed for the Jersey City Housing Authority. …As a member of the department’s brass, Zacche pulled a six-figure salary before overtime. He earned even more by working an off-duty part-time gig as a security officer for the Authority’s Marion Gardens housing development. When he retired in June, city taxpayers had to cut Zacche a check for $512,620 to compensate him for 450 unused comp and vacation days. The 61-year-old Manalapan resident is now set to collect a pension of at least $11,946 every month for the rest of his life.

That’s a pension of more than $140,000 per year. And he gets it well before age 65. No wonder New Jersey is

a fiscal mess.

Let’s also highlight a senior federal bureaucrat who

specialized in exploiting immigrants to steal money.

A chief counsel at US Immigration and Customs Enforcement (ICE) has admitted stealing immigrants’ identities to defraud banks. Raphael Sanchez, 44, forged identity documents on his government computer to open bank accounts and credit cards in the names of seven immigrants. He racked up more than $190,000 (£135,000) in personal loans, transferred funds and card-spending during the four-year scam. …He claimed three were dependent relatives on his tax returns for 2014 to 2016. …He resigned from his role at the ICE’s Office of the Principal Legal Advisor after his crimes came to light.

A chief counsel at US Immigration and Customs Enforcement (ICE) has admitted stealing immigrants’ identities to defraud banks. Raphael Sanchez, 44, forged identity documents on his government computer to open bank accounts and credit cards in the names of seven immigrants. He racked up more than $190,000 (£135,000) in personal loans, transferred funds and card-spending during the four-year scam. …He claimed three were dependent relatives on his tax returns for 2014 to 2016. …He resigned from his role at the ICE’s Office of the Principal Legal Advisor after his crimes came to light.

I’m almost impressed by this guy’s depravity. Not only did he steal identities, but he even listed some of the victims as dependents on his tax return. That’s real chutzpah!

And notice that theft and fraud apparently are not enough to get a bureaucrat fired. Instead, he resigned.

And since we’re on the topic of bureaucrats

doing bad things and not getting fired, we may as well note that the guy who sent the false alert in Hawaii is

still getting checks from the taxpayers he terrified.

The worker who sent a false missile alert to Hawaiian residents on Saturday has reportedly been reassigned. The civil defence employee has been moved to another role, but not fired, according to multiplemedia reports. In a press conference on Saturday, the head of Hawaii’s Emergency Management Agency, Vern Miyagi, said the worker “feels terrible.” …The Post also confirmed that there are no plans to fire the employee.

The worker who sent a false missile alert to Hawaiian residents on Saturday has reportedly been reassigned. The civil defence employee has been moved to another role, but not fired, according to multiplemedia reports. In a press conference on Saturday, the head of Hawaii’s Emergency Management Agency, Vern Miyagi, said the worker “feels terrible.” …The Post also confirmed that there are no plans to fire the employee.

Here’s a fourth example, dealing with a former Obama appointee who

was unmasked for screwing taxpayers.

Vikrum Aiyer liked to commute to his government job by taxi. On at least 130 occasions over two years — the majority during a four-month stretch in 2016 — the then-chief of staff for the U.S. Patent and Trademark Office called a taxi to pick him up near his home in the District. He was chauffeured across the Potomac River 10 miles or so to the agency’s headquarters in downtown Alexandria. And then…Aiyer billed the government for each ride. To escape notice, Aiyer impersonated current and former high-level agency officials, writing their names on cab receipts and vouchers he submitted to the taxi company, which then billed the government, investigators found. …Aiyer…released a statement saying he had a “misunderstanding of agency taxi rules.”

Vikrum Aiyer liked to commute to his government job by taxi. On at least 130 occasions over two years — the majority during a four-month stretch in 2016 — the then-chief of staff for the U.S. Patent and Trademark Office called a taxi to pick him up near his home in the District. He was chauffeured across the Potomac River 10 miles or so to the agency’s headquarters in downtown Alexandria. And then…Aiyer billed the government for each ride. To escape notice, Aiyer impersonated current and former high-level agency officials, writing their names on cab receipts and vouchers he submitted to the taxi company, which then billed the government, investigators found. …Aiyer…released a statement saying he had a “misunderstanding of agency taxi rules.”

Hmmm…, I think I’ll go to the grocery store later today and slip a couple of steaks into my jacket. If I get caught leaving the store, I’ll say I had a “misunderstanding of store rules.”

The good news, at least if we’re grading on a curve, is that it only took about two years for the government to realize what was happening.

Aiyer’s unauthorized rides apparently went unnoticed for at least two years by budget officials who reviewed the invoices from Alexandria Yellow Cab, which has a contract to provide authorized taxi services for agency officials. The patent office paid the taxi company more than $4,000 for Aiyer’s rides, the report says. …For most of the cab rides, Aiyer was picked up on a street corner a tenth of a mile from his home, according to the report. But he wrote on the invoice that he was leaving from Commerce Department headquarters in downtown Washington. …investigators found…that he “used the Agency’s Cab Company account to facilitate his weekend social activity… Aiyer also racked up $15,000 in expenses on his government-issued credit card, charging for food and drink at local bars, clubs, coffee shops, restaurants, grocery stores, dry cleaners and at least one liquor store, the report said. …The report says he also misstated his educational credentials on résumés he submitted to the Obama administration, claiming to have a postgraduate degree that he did not receive.

By the way, the article mentioned that Aiyer was a technology adviser for the White House. Did he advise on how to lie on your resume and how to get taxpayers to finance one’s social life?

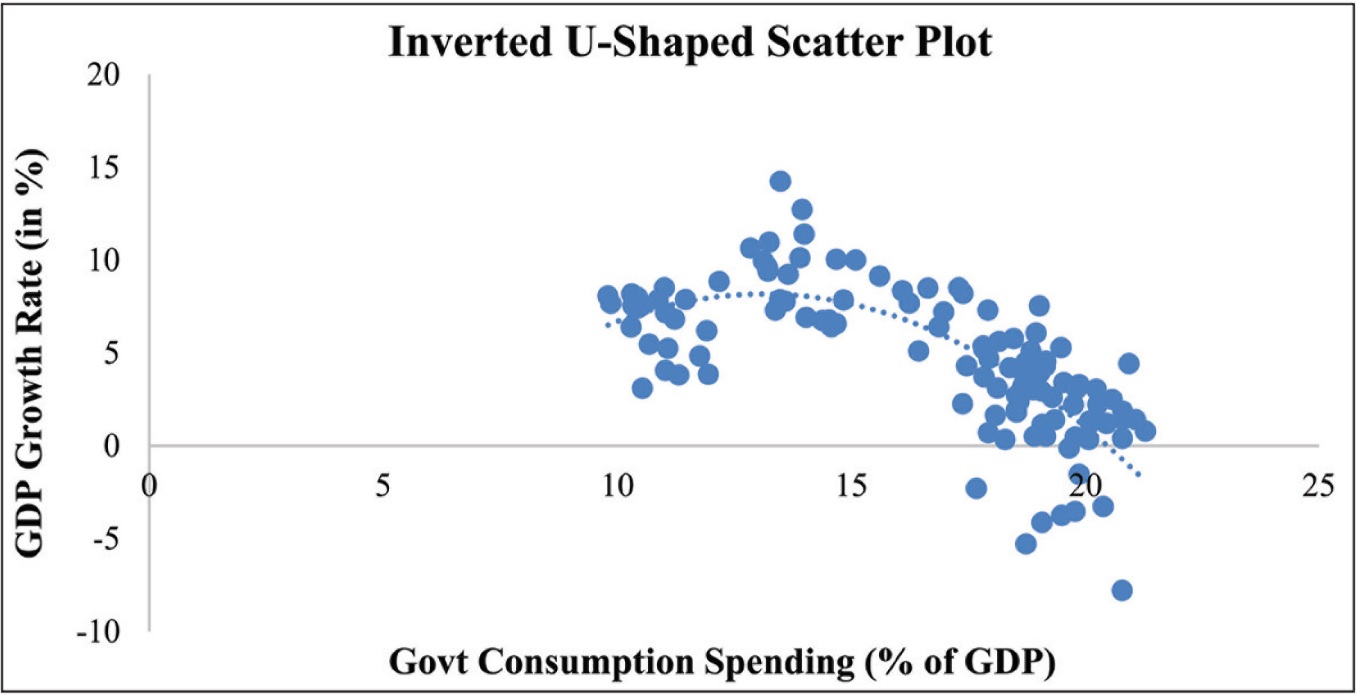

A common problem in most of these stories is that politicians and bureaucrats conspire together to create rules that enable bad behavior.

Government employee unions, for instance, give lots of money to politicians and then sit down with those lawmakers to “negotiate” pay and benefit packages.

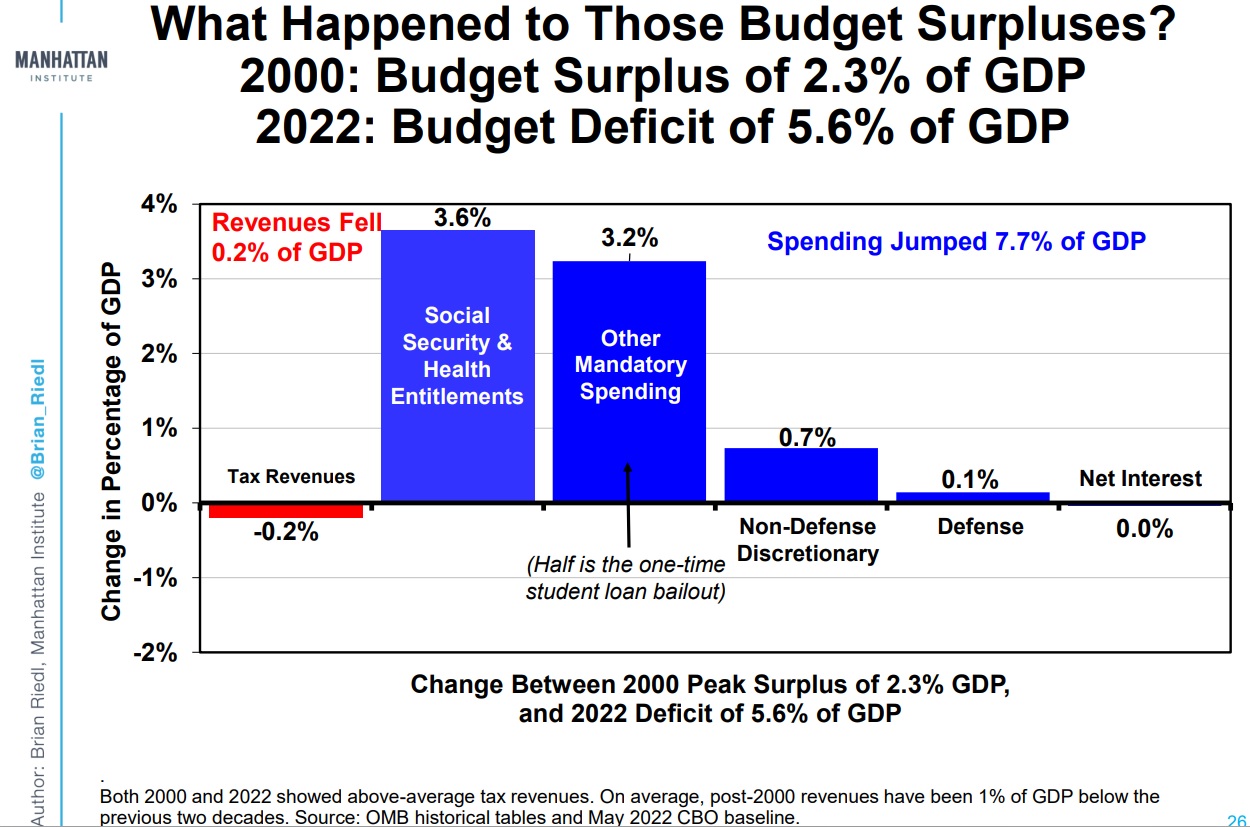

Needless to say, the interests of taxpayers don’t get represented. And that’s why many state and local governments are

careening toward bankruptcy.

What’s especially discouraging is how these deals often include loopholes that are designed to be exploited.

For instance, the

Los Angeles Times has

a very depressing exposé showing how senior bureaucrats in the police and fire departments benefited from a scam allowing them to double dip. But not just double dip. They get extra compensation and oftentimes then don’t do any work.

When Capt. Tia Morris turned 50, after about three decades in the Los Angeles Police Department, she became eligible to retire with nearly 90% of her salary. But like many cops and firefighters in her position, the decision to keep working was a financial no-brainer, thanks to a program that allowed her to nearly double her pay by keeping her salary while also collecting her pension. A month after Morris entered the program, her husband, a detective, joined too. Their combined income for four years in the Deferred Retirement Option Plan was just shy of $2 million, city payroll records show. But the city didn’t benefit much from the Morrises’ experience: They both filed claims for carpal tunnel syndrome and other cumulative ailments about halfway through the program. She spent nearly two years on disability and sick leave; he missed more than two years… The couple spent at least some of their paid time off recovering at their condo in Cabo San Lucas.

When Capt. Tia Morris turned 50, after about three decades in the Los Angeles Police Department, she became eligible to retire with nearly 90% of her salary. But like many cops and firefighters in her position, the decision to keep working was a financial no-brainer, thanks to a program that allowed her to nearly double her pay by keeping her salary while also collecting her pension. A month after Morris entered the program, her husband, a detective, joined too. Their combined income for four years in the Deferred Retirement Option Plan was just shy of $2 million, city payroll records show. But the city didn’t benefit much from the Morrises’ experience: They both filed claims for carpal tunnel syndrome and other cumulative ailments about halfway through the program. She spent nearly two years on disability and sick leave; he missed more than two years… The couple spent at least some of their paid time off recovering at their condo in Cabo San Lucas.

Yes, I’m sure they were “recovering” at their luxurious place on the beach.

Just like the other bureaucrats who exploited the system.

The Morrises are far from alone. In fact, they’re among hundreds of Los Angeles police and firefighters who have turned the DROP program — which has doled out more than $1.6 billion in extra pension payments since its inception in 2002 — into an extended leave at nearly twice the pay… Former Police Capt. Daryl Russell, who collected $1.5 million over five years in the program, missed nearly three of those years because of pain from a bad knee, carpal tunnel and multiple injuries he claimed he suffered after falling out of an office chair. …Former firefighter Thomas Futterer, an avid runner who lives in Long Beach, hurt a knee “misstepping off the fire truck,” three weeks after entering DROP, according to city records. The injury kept him off the job for almost a full year.Less than two months after the knee injury, a Tom Futterer from Long Beach crossed the finish line of a half-marathon in Portland, Ore.

Yes, you read correctly. His knee supposedly was so damaged that he couldn’t work, but he nonetheless runs long-distance races.

I’m beginning to think that firefighters in big cities are

the most cossetted of all bureaucrats. I now understand the hostility in

this video.

Here’s some background on the DROP scam.

The idea of allowing retirement-age public employees to collect their pensions while working and receiving paychecks originated more than three decades ago in tiny East Baton Rouge, La. …the goal was the opposite: to discourage older employees from staying so long that they limited upward mobility for younger workers. And it had a two-year time limit. Since then, versions of the program have been adopted by dozens of states, counties and cities across the country. The details vary — some have short terms to encourage early retirement, others have long terms to retain experience — but the central appeal for employees is constant: two large checks instead of one. …former Mayor Richard Riordan…said: “Oh, yeah, that was a mistake…it’s total fraud.” …in recent years, a growing number of jurisdictions have abandoned or drastically scaled back DROP programs because the math doesn’t work. …Instead of saving money, or remaining “cost-neutral,” the programs lead to ballooning pension costs and accusations that employees are simply double-dipping.

Needless to say, the taxpayers who finance all this aren’t treated nearly as well as government insiders.

When most Los Angeles taxpayers reach the standard retirement age, 65, they face a stark choice: keep working and collecting their paychecks or quit and start collecting Social Security, which replaces only a small fraction of annual wages for most people.When city firefighters or police officers reach their retirement age, 50, the choices are far better. They can keep working for a paycheck, they can retire with up to 90% of their salary in pension and city-subsidized health insurance for life, or they can enter DROP. For many, the choice is easy. …they keep working and collecting their paychecks for up to five years while their pension checks are deposited into a special account. …the city guarantees 5% interest on the money in the account. The city also adds annual cost-of-living raises to the pension checks to make sure they keep pace with inflation.

Disgusting.

Let’s close by speculating whether Trump will do anything to fix this mess, at least the part that occurs on the federal level.

Some pro-Trump readers sent me

this story from the

Washington Post and suggested it shows that the President is making progress.

…a year into his takeover of Washington, President Trump has made a significant down payment on his campaign pledge to shrink the federal bureaucracy… By the end of September, all Cabinet departments except Homeland Security, Veterans Affairs and Interior had fewer permanent staff than when Trump took office in January — with most shedding many hundreds of employees, according to an analysis of federal personnel data… The falloff has been driven by an exodus of civil servants, a diminished corps of political appointees and an effective hiring freeze. …Federal workers fret that their jobs could be zeroed out amid buyouts and early retirement offers that already have prompted hundreds of their colleagues to leave, according to interviews with three dozen employees across the government. Many chafed as supervisors laid down new rules they said are aimed at holding poor performers and problem workers to account. …“Morale has never been lower,” said Tony Reardon, president of the National Treasury Employees Union, which represents 150,000 federal workers at more than 30 agencies. “Government is making itself a lot less attractive as an employer.”……Agencies have told employees that they should no longer count on getting glowing reviews in their performance appraisals, according to staff in multiple offices, as has been the case for years. Housing and Urban Development managers, for example, are being evaluated for the first time on how effectively they address poor performers.

…a year into his takeover of Washington, President Trump has made a significant down payment on his campaign pledge to shrink the federal bureaucracy… By the end of September, all Cabinet departments except Homeland Security, Veterans Affairs and Interior had fewer permanent staff than when Trump took office in January — with most shedding many hundreds of employees, according to an analysis of federal personnel data… The falloff has been driven by an exodus of civil servants, a diminished corps of political appointees and an effective hiring freeze. …Federal workers fret that their jobs could be zeroed out amid buyouts and early retirement offers that already have prompted hundreds of their colleagues to leave, according to interviews with three dozen employees across the government. Many chafed as supervisors laid down new rules they said are aimed at holding poor performers and problem workers to account. …“Morale has never been lower,” said Tony Reardon, president of the National Treasury Employees Union, which represents 150,000 federal workers at more than 30 agencies. “Government is making itself a lot less attractive as an employer.”……Agencies have told employees that they should no longer count on getting glowing reviews in their performance appraisals, according to staff in multiple offices, as has been the case for years. Housing and Urban Development managers, for example, are being evaluated for the first time on how effectively they address poor performers.

If I was planning to die in the next month, I would probably agree with readers that Trump made progress in this area.

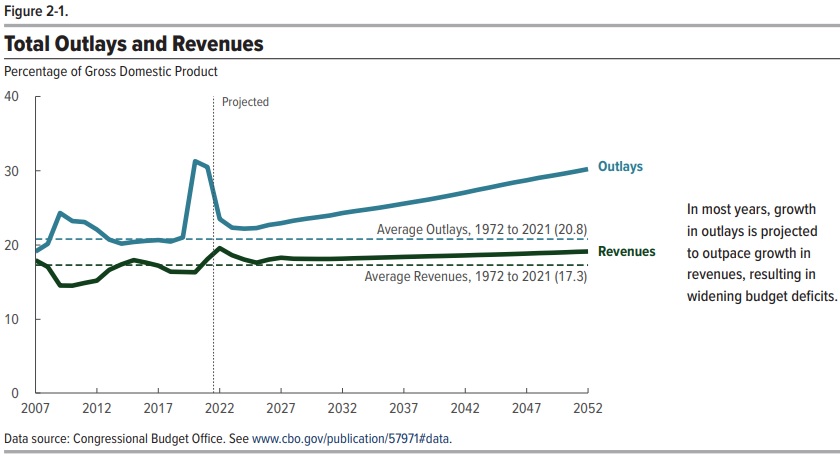

But as

I wrote last year, the only way to successfully shrink bureaucracy in the long run is to shrink government.

Yet Trump just

capitulated to a budget deal that increases spending.

I’m willing to

praise this President when he

does good things, but his weak record on spending almost surely is going to translate into a bigger bureaucracy over time. Though I hope I’m wrong.

Here are two final additional passages from the story that deserve some attention. Starting with an honest bureaucrat.

…some civil servants said they welcome the focus on rooting out waste and holding federal workers to high standards. “Oftentimes we run on autopilot and continue to fund programs that don’t produce the results that were intended,” said Stephanie Valentine, a program analyst at the Education Department. “You can’t keep blindly spending because that’s what we’ve always done.”

And since

I’ve previously contrasted Bill Clinton’s good record and

Obama’s bad record, this passage is added confirmation of my findings.

Trump already has begun to reverse the growth of the Obama era, when the government added a total of 188,000 permanent employees, according to Office of Personnel Management data. …The last time federal employment dropped during a president’s first year, President Bill Clinton was in the White House.

It’s also worth noting that the bureaucracy didn’t contract during the

big-government Bush years.

I’ll conclude by circling back to my original point. Most bureaucrats are no better or no worse than the rest of us. Given the perverse “

public choice” incentives inherent in government, however, the good bureaucrats often are lured into bad behavior and the bad bureaucrats frequently become scam artists and crooks.

P.S. If my conclusion was too grim and pessimistic, you can cheer yourself up with

another example of bureaucrat humor.