November 14, 2022 by Dan Mitchell

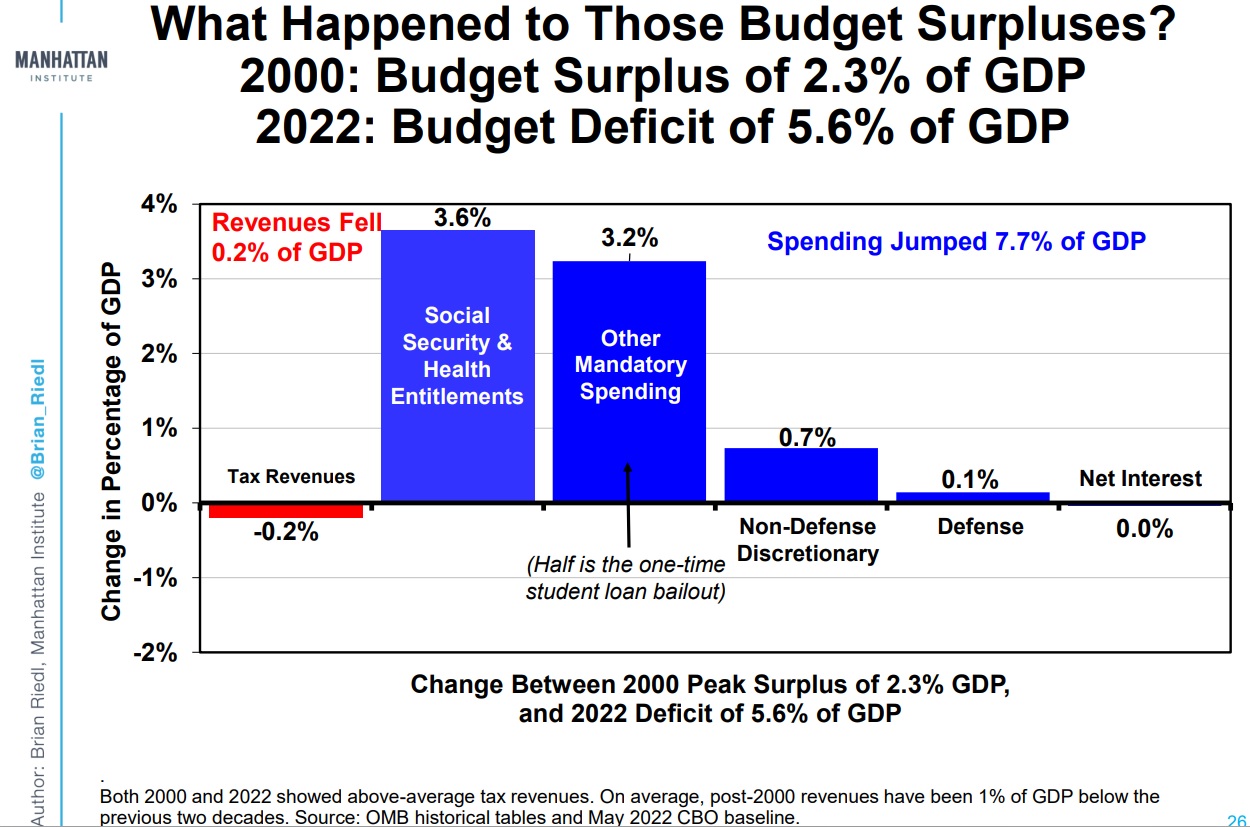

I explained last week that excessive government spending is responsible for about 97 percent of America’s fiscal deterioration in the 21st century.

I followed that column with two post-election pieces that explained how huge tax increases will be inevitable if there is no effort to deal with the spending problem.

Simply stated, lawmakers need to copy the fiscal restraint of the Reagan years and Clinton years.

Why? To help people enjoy better lives thanks to faster growth and more opportunity.

In the Wall Street Journal, Andy Kessler explains that smaller government is the recipe for more growth.

Winston Churchill…said: “We contend that for a nation to try to tax itself into prosperity is like a man standing in a bucket and trying to lift himself up by the handle.” The U.S. should heed that advice… economic growth is going to come from efficient supply chains and productivity in manufacturing in the U.S. Tax and spending cuts are the cure. …Republicans must resist the urge to subsidize higher energy costs and instead help slay inflation and bring back a strong, productive economy.

Let’s look at some new academic research bolstering Kessler’s argument.

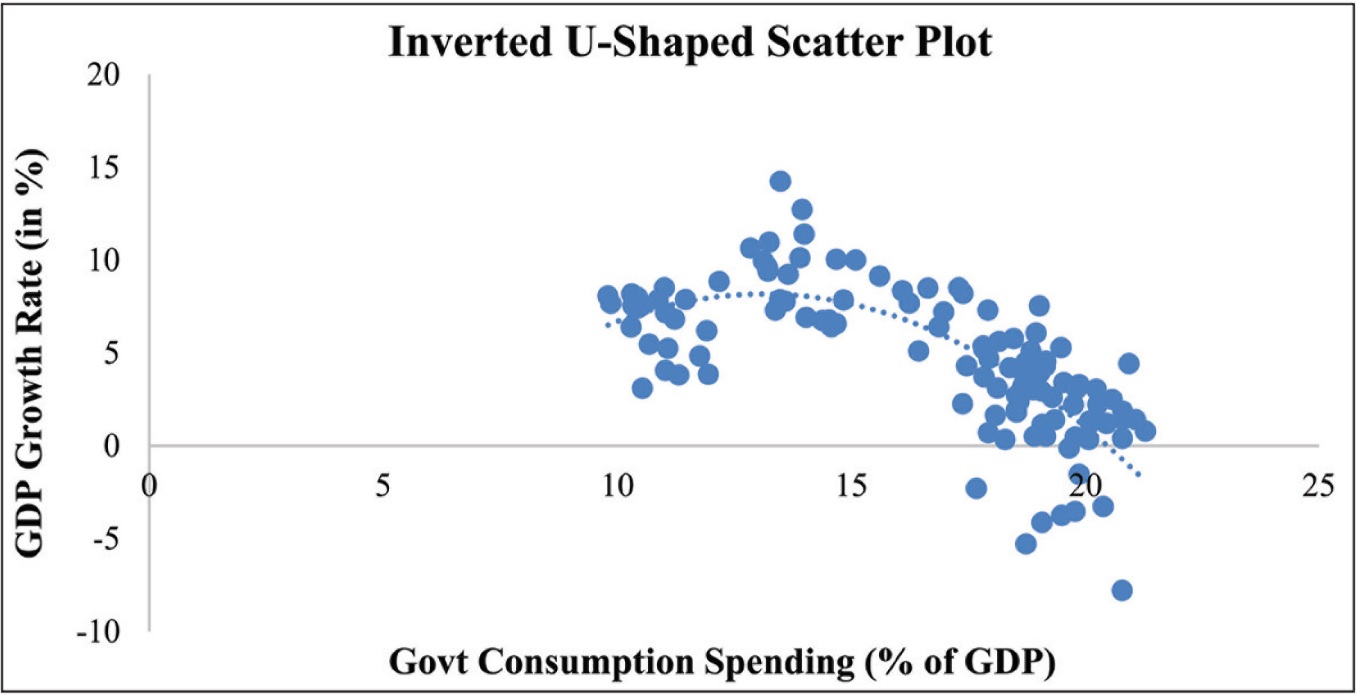

Megha Jain Aishwarya Nagpal, and Abhay Jain published a study last year in the South Asia Journal of Macroeconomics and Public Finance.

The key findings deal with the Armey-Rahn Curve and can be found in the abstract.

The current study attempts to examine the linkage between government (public) spending and economic growth in the broader framework of selected South Asian Nations (SANs), BRICS and other emerging nations by using two sets of empirical modelling over the period 2007–2016 by using inverted U-shaped hypothesis, propounded by Armey curve (1995). …The key findings signify the existence of an inverted U-shaped relationship for the selected data set of emerging nations and, therefore, support the Armey curve hypothesis. The projected threshold (tipping) levels (as a percentage of GDP) are 24.31% for the government total expenditures (GTotExp), 12.92% for consumption spending (GConExp) and 7.11% for investment spending (GInvExp). It has been observed that a rise in the public spending (size) resulted in a substantial…decrease…in the growth rate when the public spending was…after…the optimal threshold level, indicating a non-monotonic association.

For what it’s worth, I think the study is wrong and that the growth-maximizing level of government spending is much lower than 24.3 percent of economic output.

But since total government spending in the United States now consumes about 40 percent of GDP, at least we can all agree that there will be more prosperity if America’s fiscal burden is dramatically reduced.

If we ever bring the spending burden back down to 24.3 percent of economic output, we can then figure out whether the ultimate goal is even lower (as it was for much of America’s history).

There is one point from the study that merits further attention. The authors estimated not only the growth-maximizing level of total spending, but also how much the government should spend on “consumption” and “investment” outlays (an issue I addressed last month).

Here’s a chart from the study showing that consumption outlays should be less than 13 percent of economic output.

P.S. If you want to watch videos that address the growth-maximizing size of government, click here, here, here, here, and here.

P.P.S. Ironically, the case for smaller government is bolstered by research from normally left-leaning international bureaucracies such as the OECD, World Bank, ECB, and IMF.

No comments:

Post a Comment